Table of Content

PNC Mortgage is a division of PNC Bank, National Association, a subsidiary of PNC. If you used PNC Online Banking to schedule a payment to your PNC Home Equity Loan Account to occur before February 22, 2018, it will not be affected. If you used PNC Online Banking to schedule a payment to your PNC Home Equity Loan Account to occur on or after February 22, 2018, it may be canceled. Regular maintenance and minor repairs are a part of homeownership.

Choose PNC for checking accounts, credit cards, mortgages, investing, borrowing, asset management and more — all for the achiever in you. As you compare loan offers, use a HELOC or home equity loan calculator to compare your costs of borrowing. With a calculator, you can get a sense of your monthly payments and long-term interest charges.

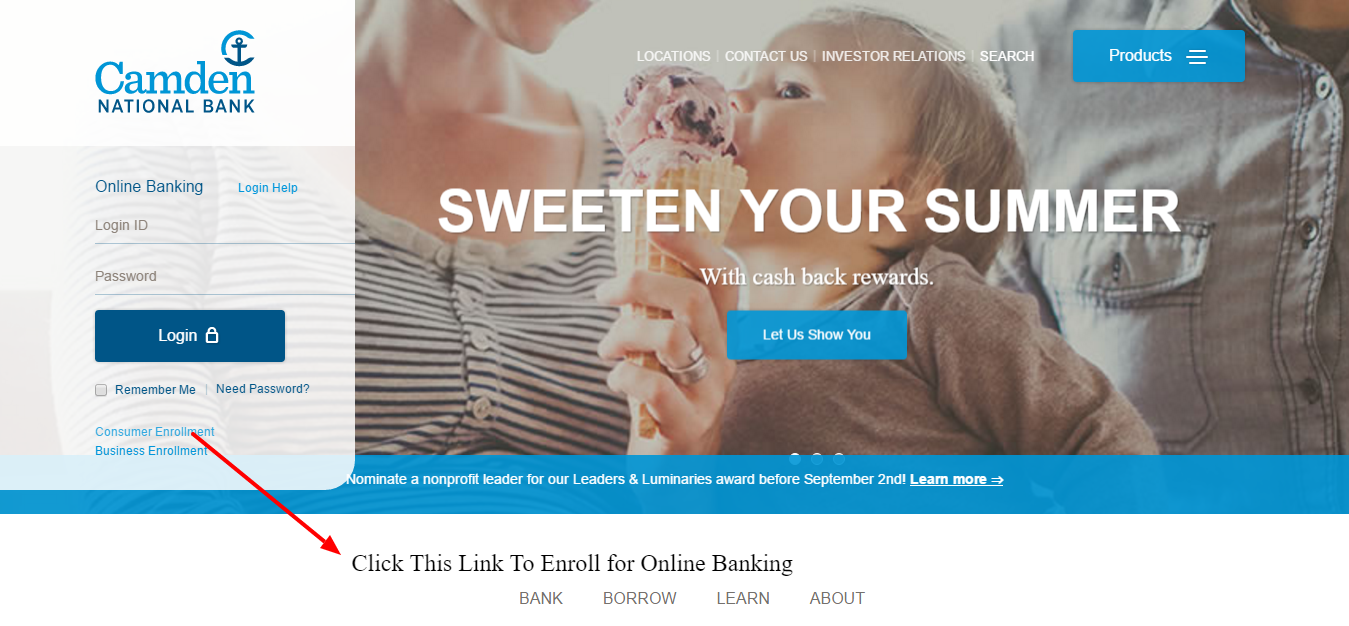

Log in to your other accounts

PNC offers personal loans and lines of credit that don’t require borrowers to put up their homes as security. The maximum loan amount is $35,000, while the top credit line limit is $25,000. Investment lines of credit up to $5 million are also available. A personal loan or line of credit may be suitable for borrowers who don't want to use their home as collateral or only need to borrow a smaller amount. The main difference is that a home equity loan delivers a lump sum that you pay back in monthly installments.

We aggregate them based on user trustworthiness for each site. We cannot give any guarantees because these sites don't belong to us. Microsoft 365 is widely accepted in most organizations and businesses.

PNC $30,000 HELOC

Although one loan might have a lower rate than another, it could cost more overall if the lender charges hefty fees. Consider the interest rate, fees, and repayment terms so you can compare loan offers on an apples-to-apples basis. Before borrowing a loan, it’s always a good idea to shop around. By comparing loan offers from multiple lenders, you can find one with the most appealing rates and terms.

With a TD Bank Home Equity Line of Credit or Loan, you can renovate and improve your home, consolidate debt, finance education and make major purchases. HELOCs are flexible, allowing you to borrow as needed, up to your credit limit. It’s similar to having a credit card, but secured by the equity in your home.

How to Apply for PNC Home Equity Loans

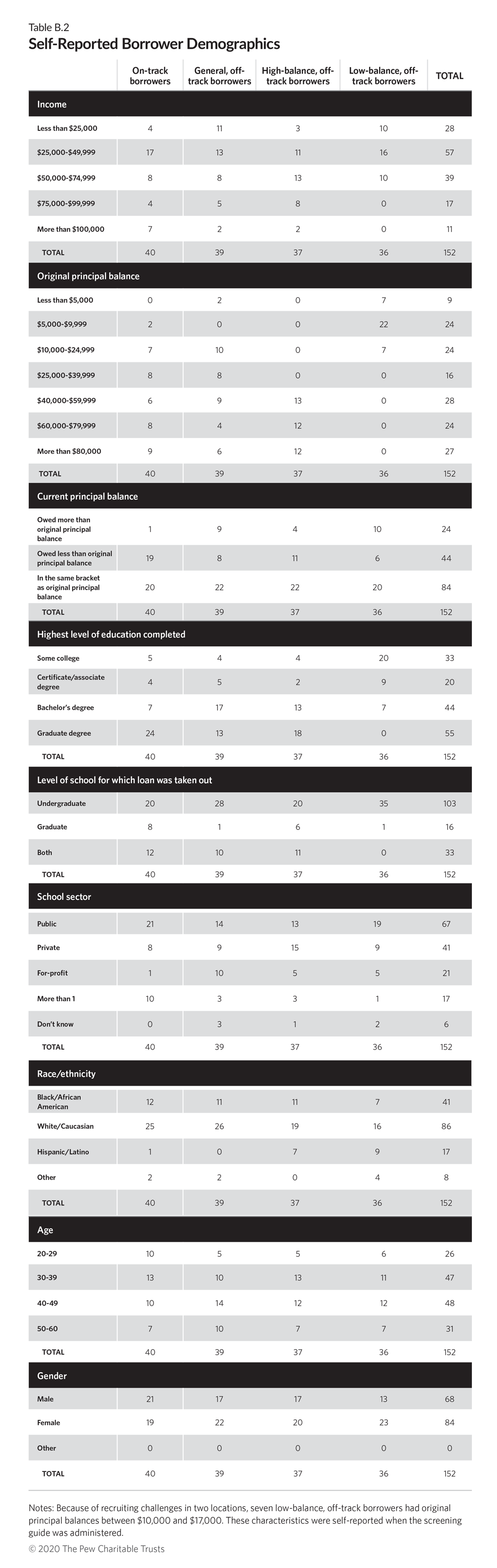

These ratings are subjective and are based on a combination of expert opinions and first-hand experiences from consumers who are or have been PNC customers. Borrowers also need to tell PNC whether they have any outstanding loans on the property already, including a first mortgage or other home equity loan. Rates may be higher depending on credit score, LTV, and other PNC criteria.

PNC Bank makes it easy to check your HELOC rates online early in the application process. While the bank doesn’t offer a home equity loan, its flexible HELOC options may be worth exploring if you’re looking to borrow against the equity of your home. Borrowers with the best credit scores tend to get the lowest rates on loans, including HELOCs and home equity loans. To make yourself a competitive borrower, spend some time working on your credit score before you apply.

Compare Products Offered

But if your home needs more costly repairs, like a new roof or floors, using your home equity could be a smart choice. Estimating the cost of your project is the first step. Get quotes from multiple contractors, and to be safe, add 20-30% to the total to account for potential ... Pnc Bank Home Equity Login will sometimes glitch and take you a long time to try different solutions. LoginAsk is here to help you access Pnc Bank Home Equity Login quickly and handle each specific case you encounter.

3The interest rate is fixed for the life of the loan. Available on 1–4 family primary or secondary residences, excluding mobile homes, boats, RVs, and homes for sale, under construction or on leased land. For co-ops, additional terms and conditions will apply. For a property value greater than $2.5 million, additional terms and conditions may apply. Finish applying and check the status of your application.

Use TD Home Loan Match to see rate and payment options to help you find the best loan to get cash out of your equity. When homeowners need extra cash, they often borrow against the equity in their home, known as home equity loans or lines of credit . PNC also offers three different types of home equity options, including a HELOC, a home equity loan, and a so-called “Home Equity Rapid Refinance.”. Use the calculator to determine your monthly home equity line of credit payment for the loan from PNC Bank, National Association.

As mentioned, PNC does not offer a standard home equity loan option, nor does cash-out refinancing appear to be available. PNC also doesn't disclose how applicants qualify for a HELOC. Borrowers may submit their applications only to find they aren't eligible, based on their credit scores, income, or both. In terms of transparency, PNC makes it difficult to estimate the cost of a HELOC without prequalifying.

Find out what information and documents you’ll need to apply for your home equity loan or line of credit. Jan 13, 2016 — – PNC is consolidating its technology onto one servicing platform for mortgages and home equity loans to improve efficiency and risk management. Unlock your home’s equity with M&T’s CHOICEquity Account and you can count on competitive rates and outstanding service.